In addition to air traffic, the aviation industry creates many jobs on the back of Dutch and foreign orders. For these jobs, the introduction of new aircraft (including the Boeing 787 and the Airbus A380 and A350) is an important development. These new generation aircraft are bigger, lighter, quieter and more fuel-efficient, as shown in Figure 15, in response to ever-rising fuel prices.

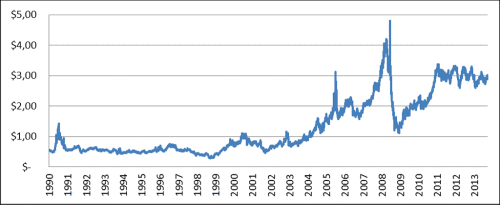

The race to reduce fuel costs has intensified over the past few years, partly given the outlook for future fuel prices, as shown in Table 16.

| Year | Jet fuel prices |

|---|---|

| 2010 | $ 2.19 |

| 2011 | $ 3.04 |

| 2020 | $ 3.35 |

| 2025 | $ 4.04 |

| 2030 | $ 4.85 |

| 2035 | $ 5.82 |

| 2040 | $ 6.92 |

| Annual growth | 2.90% |

However, larger, lighter and more fuel-efficient aircraft call for different solutions in terms of design, maintenance and repair (methods) while imposing different qualification and training requirements on staff. For example, the increasing use of actuators, sensors and composites in new generation aircraft requires very different skills and qualifications of employees, as does the continuing evolution of turbines and the development of new service models and in-flight entertainment systems.

All of the above suggest that there is an urgent need for training in the aviation industry. And there are new developments in store for the distant future. For example, concepts that affect structure and propulsion are being considered. Moving forward, this presents an excellent opportunity for the Dutch industry to develop new business activities and employment. The Dutch aviation industry occupies a strong position on the market, developing and supplying among other things the following innovative products that are necessary for the new generation of aircraft.

| Product category | Products |

|---|---|

| Aerostructures | Tails Moving wing parts Fuselage panels |

| Materials | Coating systems Thermoplastic composites Fibre-metal laminates High-temperature coatings |

| High-tech aircraft systems (new aircraft and maintenance) | Electrical wiring Interior/catering parts Landing gear components Sensors Actuators Fuel systems |

| Engine components and subsystems (new aircraft and maintenance) | Subassembly high-pressure compressor Blisks and impellers Casings, seals, shrouds Turbine blades Auxiliary jet engines Engine starters |

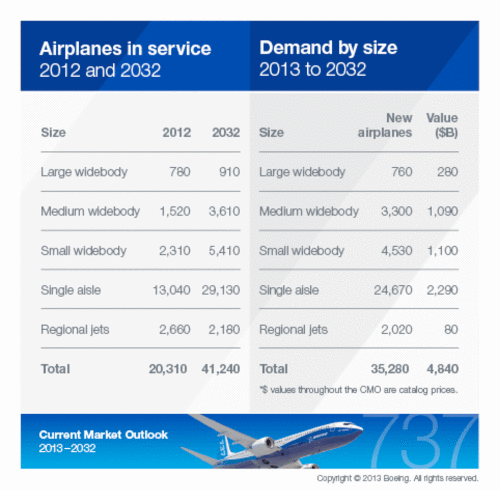

Airbus expects 29,226 new aircraft to be built worldwide by 2032, which is a slightly lower estimate than that of Boeing. Airbus predicts that future cargo and passenger flows will be handled mainly by large to very large aircraft.

As a result of faster and advancing fleet renewal, there will be a turning point in the next few years, with new generation aircraft types taking centre stage.

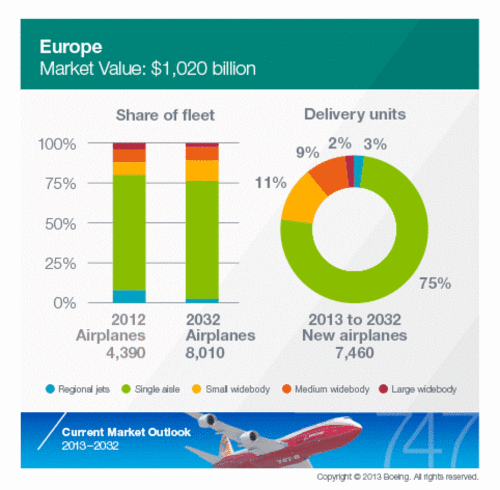

It is expected that, in the next 20 years, 7,460 aircraft, predominantly new generation ones, will be supplied to the European market. However, type and scale of work expectations suggest that there will be a lack of technicians with the relevant skills. We will need more technicians, ready to master new technologies through training and retraining. That, on the other hand, presents opportunities for new foreign orders and for new, sustainable jobs in the Netherlands.